August 2013 Issue

New Debt Servicing Ratio (TDSR) And You

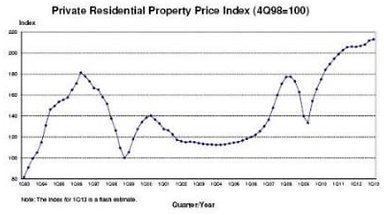

In recent years, the property market has outperformed all other financial instruments and this has led the government to introduce countless cooling measures over the last 2 years to prevent a price bubble.

However, there seems to be no stop for speculation and this has resulted in MAS coming up with the latest measure, which will be the main discussion today.

MAS Introduces Debt Servicing Framework for Property Loans

On 29th June 2013, MAS announced the standardization of the debt service ratio which banks have to use when granting property loans. Debt service ratio is the percentage of a borrower's gross income that is used to make mortgage repayment.

The Total Debt Servicing Ratio (TDSR) framework for all property loans granted by financial institutions (FIs) to individuals is introduced. The TDSR is capped at a maximum of 60%, taking into consideration all debts. which includes

-

Property Loans

-

Personal Bank Loans

-

Credit Card Outstanding Balances

-

Car Loans

Other ruling includes:

-

Medium term interest rate is used for calculation instead of prevailing interest rate

-

Borrowers named on a property loan must now also be mortgagers of the residential property for which the loan is taken.

What this means to you

Using a simple example, John and Mary, both 35, are married with 2 kids, with a combined income of S$120,000 per annum, have the following assets and loan.

They would have a total loan amount of S$2,221 per month combines. Should they wish to buy another property, the maximum monthly loan instalment amount they can take now is S$3,779.

Based on the new ruling of medium term interest rate of 3.5%, with a loan term of 30 years (till age 65 only), the maxium loan they can take up is estimated to be S$380,000 for any property they intend to buy.

In Summary

What the government is trying to do is to prevent people, in the hype of increasing property prices, from over leveraging and getting complacent in assuming that prices will keep going up. We need to understand that there is no guarantee in life.

-

No guarantee that property price will keep going up

-

Interest rate will stay low at 1%

-

Rental is guaranteed for homes

-

We are guaranteed to enjoy our income, and we won't lose our job.

Although wealth accumulation has slowly become an obession with Singaporeans, it's always important for us to always maintain financial prudence and ensure that we cover all risks and protect our income.

Seek advice from your trusted Financial Consultant when making major financial decision so that when unfortunate events in life hits us, we know that we are well shielded and not burden ourselves and our families with huge debts.